Healthcare Claims Audits FAQs

Below are the most common questions we receive about Medical and Pharmacy Claims Audits. If we can assist with any specific needs or questions, please reach out to us.

The basics.

What is a healthcare claims audit?

A healthcare claims audit is a review of medical and/or prescription drug insurance claims data to check for errors and make sure claims are paid correctly by the third-party administrator (TPA) or pharmacy benefit manager (PBM). These audits help ensure accuracy, detect overpayments, underpayments, or fraud, and confirm that the payer's systems follow plan rules, legal requirements, and contracts.

How can I be sure my healthcare claims are being processed correctly?

The only way to be sure healthcare claims are being processed correctly is to perform a claims audit. A claims audit will identify errors, confirm the plan is being administered as intended, and demonstrate compliance with federal regulations like ERISA, Sarbanes Oxley, and the Department of Labor (DOL) rules.

What types of errors are found during a healthcare claims audit?

A healthcare claims audit can identify a variety of error types that occur during the claims process. These errors can lead to overpayments, underpayments, or noncompliance with regulations. Below are some of the common types of errors found during a healthcare claims audit:

Plan Design Errors

Plan design errors are mistakes or inconsistencies between claims processing and how the health plan is structured or documented. These include:

Incorrect copayment or deductible setups

Excluded services, such as cosmetic procedures or over-the-counter items

Misapplied benefit limits or exclusions, such as exceeding therapy visit limits

Payment for services that required prior approval from the insurer but were not authorized

Standard Industry Practice Violations

Standard industry practice violations refer to instances where claims are processed in ways that don't align with widely accepted healthcare or insurance industry norms. These include:

Use of invalid codes or inappropriate modifiers

Medically unlikely edits (units exceeding standard medical usage)

Incorrect application of bilateral or global payment rules

Unwarranted assistant or co-surgeon billing

Unbundling of procedures that should be billed as a single service.

Fraud, Waste, & Abuse Indicators

Claims that have Fraud, Waste, & Abuse indicators are those that could be misrepresenting a service, gaining financial benefit, or expending resources carelessly. These include:

Duplicate claims

Billing for services without proper destination, such as ambulance errors

Eligibility Errors

Eligibility errors are found in claims when the plan’s eligibility criteria are not met, but the claim is still paid by the plan. These include:

Dependents over the age of 26

Claims paid after the member’s termination date

Cost Control & Payment Errors

Cost control and payment errors are mistakes that result in overpayments, underpayments, or missed opportunities to reduce costs. These include:

Lack of medical necessity documentation

Overpayments due to pricing errors or missing provider discounts

Underpayments due to pricing errors or missing provider discounts

Other Party Liability Errors

Other party liability (OPL) errors are identified in claims that could potentially have another party that is responsible for the claim payment. Our auditors make selections and review claim-related documentation (eligibility dates, coordination of benefit documentation, accident details, etc.) to determine if another party is responsible for claim payment.

Review of high-cost claimants for stop-loss coverage

Failing to comply with the coordination of benefits (COB) when multiple insurers are involved - primary vs. secondary payer mistakes

Unaccounted third-party liability (e.g., workers’ compensation)

These errors can result from human oversight, system issues, lack of training, or weak investigative efforts. To see real-world examples of audit findings, visit our blog.

What if I find an incorrectly paid medical or pharmacy claim?

If you find an incorrectly paid healthcare claim within your plan, an audit of all claims should be conducted by a third-party auditor to confirm there are no more errors. Any errors that are uncovered should be presented to the third-party administrator or pharmacy benefit manager to ensure the system and processes are corrected and claims are adjusted as applicable.

When is the best time to conduct a healthcare claims audit?

Now is the best time to conduct a healthcare claims audit!

BMI advises beginning with an audit of the most recent 18 months of paid claims, followed by annual audits covering 12 months. It is best to align the audit period with the benefit plan for a complete review of items like deductibles and out-of-pocket calculations.

It is also important to conduct Implementation Audits when switching administrators, implementing plan design changes, or moving to a self-funded plan for the first time. This helps to ensure that the plan is set up correctly from the beginning and avoids incorrect payments due to implementation errors.

How long does a healthcare claims audit take?

A healthcare claims audit typically spans 5–7 months from start to finish. The timeline is influenced by factors such as the availability of third-party administrators and pharmacy benefit managers. For plan sponsors or broker consultants, the process requires minimal effort, approximately 1-3 hours total, to submit plan documents, review email updates from BMI, and join kick-off and wrap-up sessions.

How often should I conduct a Medical + Rx Claims Audit?

Best practice is to conduct claims audits annually, particularly after plan changes, major claims activity, or contract renewals. Regular audits help identify errors and cost-saving opportunities and demonstrate strong fiduciary responsibility and minimize risk.

How much does a healthcare claims audit cost?

The cost of a healthcare claims audit is dependent on various factors like the number of plans and enrolled members, as well as the type of audit.

Request a quote so that we can provide you with a cost that aligns with your plan needs.

The benefits.

Why is it important to conduct a Healthcare Claims Audit?

Here’s why conducting a Healthcare Claims Audit is important:

Compliance. Increased scrutiny by the Department of Labor (DOL) relative to proper discharge and monitoring of ERISA fiduciary duties by employers and/or sponsors of group health plans is reason enough to conduct an audit. Plan sponsors put a lot of effort into designing health care benefits for their employees and want to be assured that these benefits are being provided at the right cost. Based on data gathered from BMI customers in 2024, compliance was the top motivator for conducting an audit.

Fiduciary responsibility. Many employers have never conducted an audit, yet draft authority on their bank account is granted to the third-party administrator for payment of the organization’s health care claims. Audits provide assurance that benefits are being provided as intended and claims are being paid accurately.

Rising costs. The cost of health care benefits is among the largest expense items for an employer and along with comprehensive healthcare reform, self-insured employers are facing additional pressures to ease the financial strain.

Suspected or known issues. Sometimes, an incorrectly processed claim is discovered through the normal course of business. The most effective way to ensure that no additional errors are going undetected is by conducting a thorough medical or pharmacy claims audit.

What outcomes do employers see from a claims audit?

Identified errors typically range from .5% to 3% of annual claims spend. Savings could be received in the form of a reimbursement of monies paid in error and/or internal correction to eliminate future errors. Some TPAs will even help fund the cost of a follow-up audit.

See actual audit results here.

How does a claims audit impact healthcare costs?

By identifying claims processing errors, audits help prevent future waste and ensure vendors follow contract terms, ultimately reducing overpayments and protecting plan funds.

What healthcare plans benefit from a claims audit?

Self-funded healthcare plans of all sizes benefit from claims audits, especially those with recent TPA transitions or high claims volume. Organizations that have not audited their plan in the past two years, experienced mergers or eligibility changes, or want to validate vendor performance and compliance are ideal candidates for a medical and pharmacy claims audit.

How does a healthcare claims audit support fiduciary duty under an ERISA Audit?

Under ERISA, fiduciaries are required to act prudently and solely in the interest of plan participants. A claims audit supports this duty by verifying that claims are paid accurately, according to plan terms and contractual agreements. Audits provide documented supervision, help identify systemic errors and show that plan assets are being managed responsibly.

By proactively identifying errors and evaluating administrator performance, audits demonstrate careful management of plan assets, which is critical for ERISA compliance and avoiding litigation

Types of audits.

What types of healthcare claims audits does BMI offer?

BMI Audit Services offers the following types of audits:

Medical Claims Audit

A medical claims audit is a review of medical insurance claims data to check for errors and make sure claims are paid correctly by the third-party administrator (TPA). The audit examines key areas such as duplicate charges, eligibility, standard industry practices, potential other party liability, and compliance with plan design and contract terms.

Prescription Claims Audit

A prescription (Rx) claims audit is a review of pharmacy insurance claims data to check for errors and make sure claims are paid correctly by the pharmacy benefit manager (PBM). The audit examines key areas such as dispensing fees, copayments, deductibles, out-of-pocket maximums, plan design compliance (including days’ supply limits, specialty drug rules, and exclusions), and plan utilization management (including prior authorization, quantity limits, and step therapy).

Additionally, a prescription drug claims audit can also include a Prescription Drug Manufacturer Rebate Audit and/or a Contractual Financial Guarantee Audit.

What sampling methodologies are available?

Focused Sampling

With focused sampling, 100% of paid claims are systematically reviewed against the client’s specific plan design using BMI’s proprietary category-based algorithms, which flags claims with potential errors. Flagged claims are then reviewed by experienced auditors who use their expertise to make final sample selections. This methodology may also be referred to as a comprehensive, judgmental, targeted or a 100% review audit.

Random Sampling

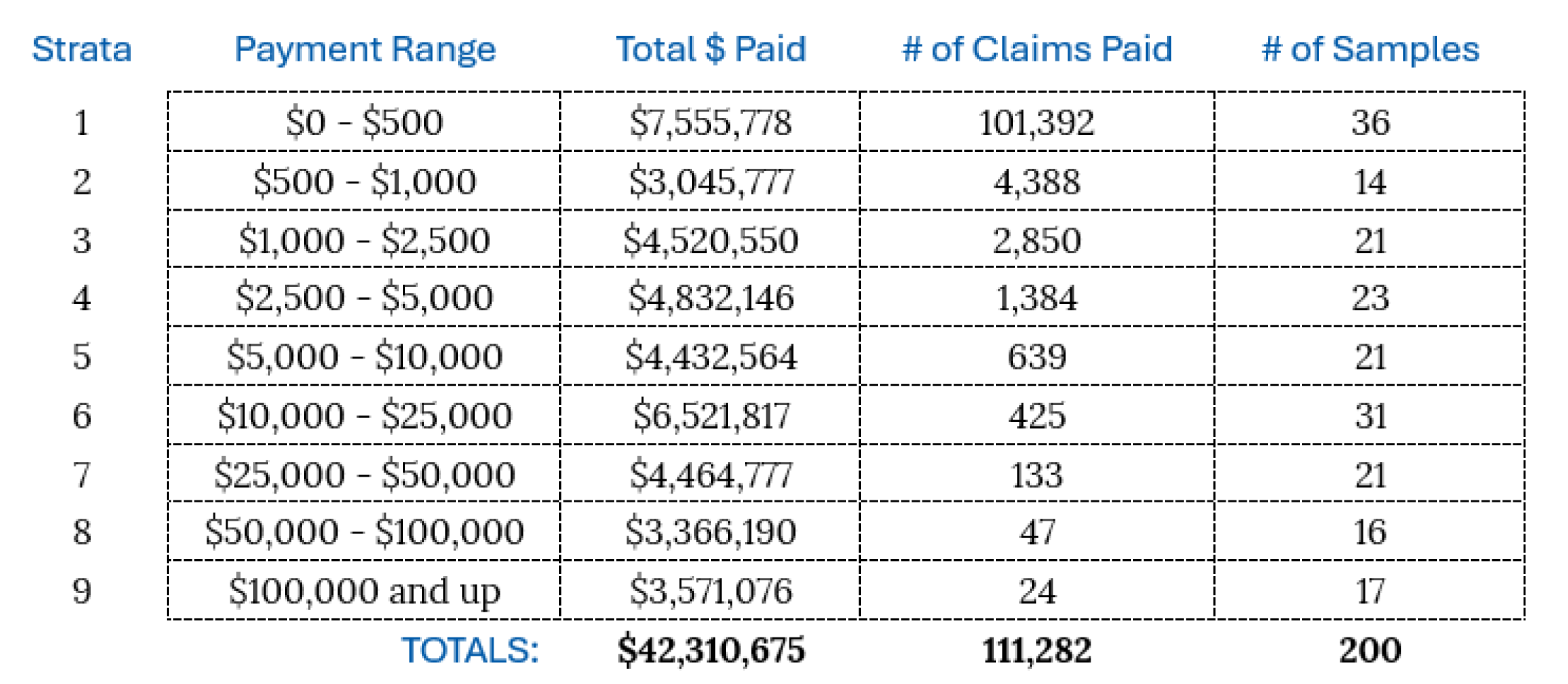

Random sampling begins with stratifying claims by the paid amount, such as $0 - $500, or $100,000+. A predetermined number of samples will be randomly selected from each stratum. These random samples are reviewed by experienced auditors who will determine if any of these claims have errors.

Here is an example of how BMI would stratify and select 200 random samples from 111,282 claims totaling $42,310,675 in paid claims:

Hybrid Sampling

Samples are chosen using a combination of focused and random sampling methodologies. This is best for plans that want a thorough review, as well as a measurement of performance guarantees.

Which sampling methodology is best?

Due to its effectiveness, BMI recommends conducting a focused audit. This is because the focused methodology programmatically reviews 100% of claims, with samples being selected by an expert auditor from those identified by the software as having potential errors. Using the focused sampling methodology is best for plans that want the most thorough review.

However, the decision is largely influenced by the plan sponsor’s desired outcome and the intended use of the results. Oftentimes, the Administrative Services Only Agreement (ASO) between the plan sponsor and third-party administrator dictates which approach may or may not be permitted.

What is a Prescription Drug Manufacturer Rebate Audit?

A prescription drug manufacturer rebate audit is a review of each manufacturer’s rebate program to confirm that the correct pharmacy rebate amounts are being passed through and delivered back to the plan sponsor per the contracts. These audits help ensure that plan sponsors are receiving their full share of rebate dollars.

What is a Contractual Financial Guarantee Audit?

A financial guarantee audit evaluates whether a PBM is meeting the financial and/or performance guarantees outlined in the Administrative Services Only (ASO) contract, helping plan sponsors fulfill their fiduciary responsibilities.

This audit includes:

Complete contract analysis with consultative and cost containment recommendations.

Thorough evaluation of compliance with all contractual financial guarantees, such as average wholesale price (AWP) discounts, dispensing fees, minimum rebates, generic dispensing rates, and other applicable guarantees.

How it’s done.

What is the claims audit process?

BMI’s Medical and Pharmacy Claims Audit follows a structured, multi-step process to deliver accurate results and actionable insights:

Kickoff & Planning

We begin with a kickoff call to align on audit goals, timelines, and responsibilities. The client shares plan documentation and sends the audit notification to the TPA and/or PBM.Data Analysis & Sampling

BMI analyzes data provided by the TPA/PBM and makes sample selections based on the chosen sampling methodology.Audit Review & Validation

The BMI team of auditors works together with the plan administrator to review a sample of claims. Claims are tested against various categories within the groupings of Plan Design, Standard Industry Practices, Eligibility, Cost Control Programs, Other Party Liability, and Fraud, Waste, & Abuse.Reporting & Recommendations

Findings are shared through a detailed audit report, confirming correct and incorrect claims, accuracy ratings, and cost recovery opportunities. A wrap-up session follows to discuss the findings and recommend next steps.

Typical audit timeline: 5–7 months, depending on administrator availability and data readiness.

What documents are needed to start a claims audit?

To start a claims audit, BMI will need the Summary Plan Descriptions (SPDs), plan amendments, stop-loss contracts, and the ASO agreement from the plan sponsor. The TPA/PBM will provide claims data and eligibility files.

What do I need to consider when selecting an auditing firm?

It is important for organizations to do their homework before engaging with any audit firm. A few key considerations or questions to ask:

How long have they been in business?

How many audits have they successfully completed?

What third-party administrators have they worked with?

What type of audit technology or software is utilized?

Does the firm specialize in healthcare claims auditing?

Do they offer an audit approach that meets the organization’s objectives?

Do they offer additional services or products that could be considered a conflict of interest?

Does BMI use software for conducting a Claims Audit?

Yes. BMI utilizes its own proprietary healthcare claims auditing software. AUDiT iQ™ is a healthcare claims auditing software designed to analyze 100% of claims data and efficiently identify inaccurate payments for sample selection during focused claims audits.

What happens after a healthcare claims audit?

After completing a medical or pharmacy claims audit, BMI delivers a final report and hosts a wrap-up session to discuss the findings and provide guidance on any next steps that may need to be taken with the plan administrator.