Audit Finding of the Month

Since 2011, our Audit Finding of the Month provides insights into what drives BMI to help organizations uncover who and what their healthcare dollars are being spent on.

Real-world examples of how we help our clients.

A comprehensive review of 5,619 dependents revealed how eligibility gaps can impact a healthcare plan. Through structured dependent eligibility verification, the employer identified 37 ineligible dependents and 319 unverified dependents. Combined, these findings pointed to $2.49M in potential annual savings. The case illustrates why regular verification is essential for accurate enrollment and long-term cost control.

Through a detailed medical claims audit, BMI Audit Services uncovered key compliance and payment issues totaling over $350,000 in potential exposure for a labor union health fund, reinforcing the importance of accuracy and fiduciary responsibility in healthcare plan administration.

Post-implementation audits act as a critical ‘second check’ for new health plan designs. In this case study, BMI reviewed 1,100+ medical and prescription claims scenarios, confirming accuracy, uncovering discrepancies, and helping the plan sponsor protect compliance and member trust.

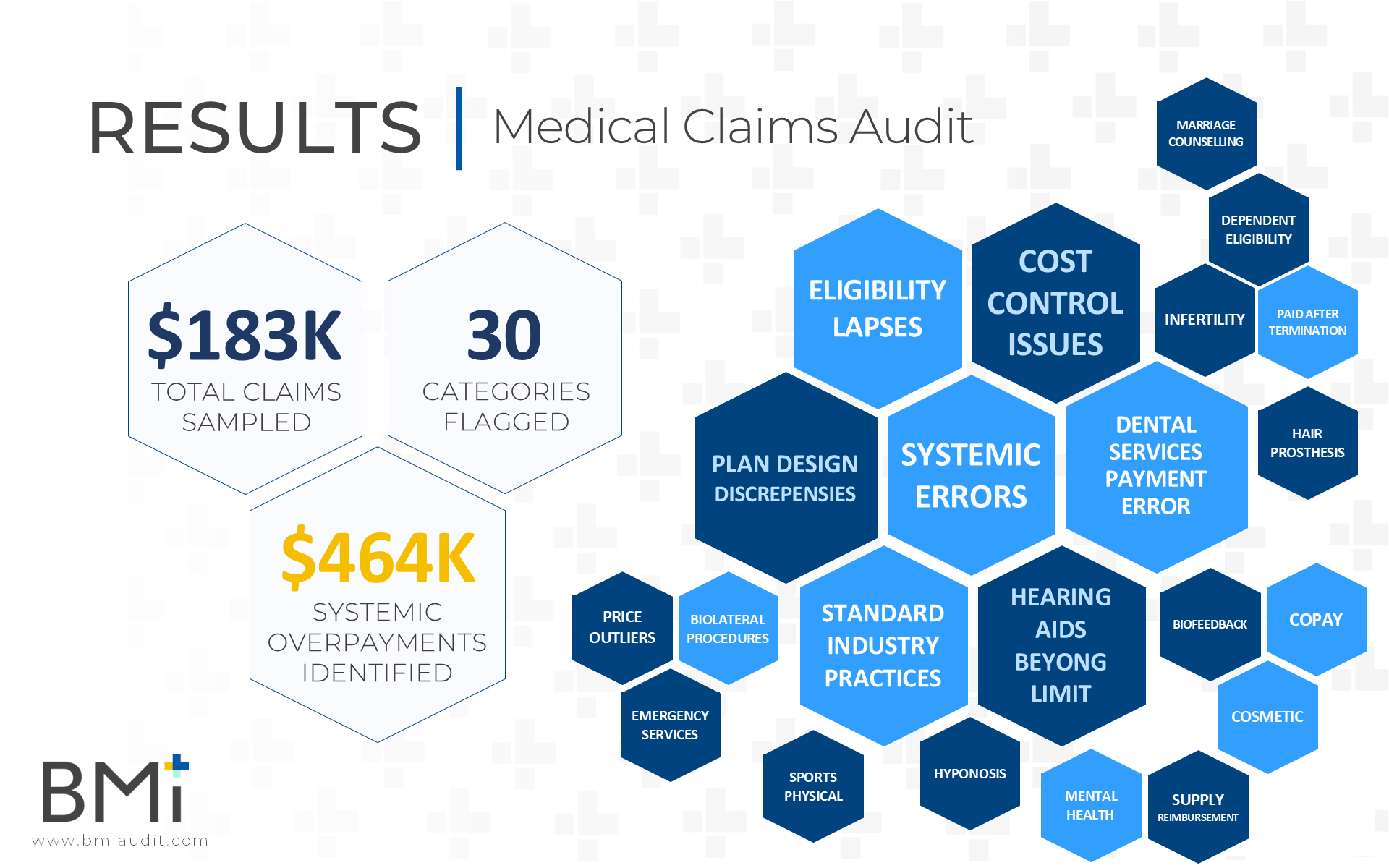

BMI’s Medical Claims Audit revealed 30 categories of errors impacting compliance and plan performance. For plan sponsors, regular claims audits ensure SPD alignment, accurate payments, and fiduciary accountability, helping reduce hidden costs and improve compliance across healthcare benefits administration.

A large healthcare employer saved nearly $3 million in one year simply by verifying who actually belonged on their health plan. With over 11,000 dependents enrolled, a Dependent Eligibility Verification Audit uncovered hundreds of ineligible individuals, driving nearly 3,000% ROI. This real-world case study shows how proactive verification not only reduces waste but strengthens compliance and protects long-term benefit sustainability.

A focused prescription claims audit revealed $464K in systemic overspending, eligibility lapses, and compliance issues stemming from SPD misalignment. By reviewing $183K in sampled claims, BMI Audit Services helped a public sector health plan identify errors, reduce financial risk, and strengthen fiduciary oversight.

Discover how a multi-employer health plan used a dependent eligibility audit by BMI Audit Services to save $2.42 million in just one year. Learn the process, results, and benefits of auditing dependent health coverage.

An employer in the healthcare field with 4,000 employees engaged BMI to conduct an implementation audit of their new third-party administrator (“TPA”) to ensure accuracy of their claims processing prior to going live for the new plan year.

A major retail employer suspected their medical claims weren’t being processed correctly—and they were right. With the help of BMI Audit Services, they uncovered $28K+ in overpayments due to errors in copayments, coordination of benefits, and plan exclusions.